By Olivia Rudgard and Hayley Warren

British Chancellor Rachel Reeves has brushed aside concerns about the climate impact of expanding London’s Heathrow airport, insisting there is “no trade off” between the pursuit of economic growth and the UK’s desire to decarbonize.

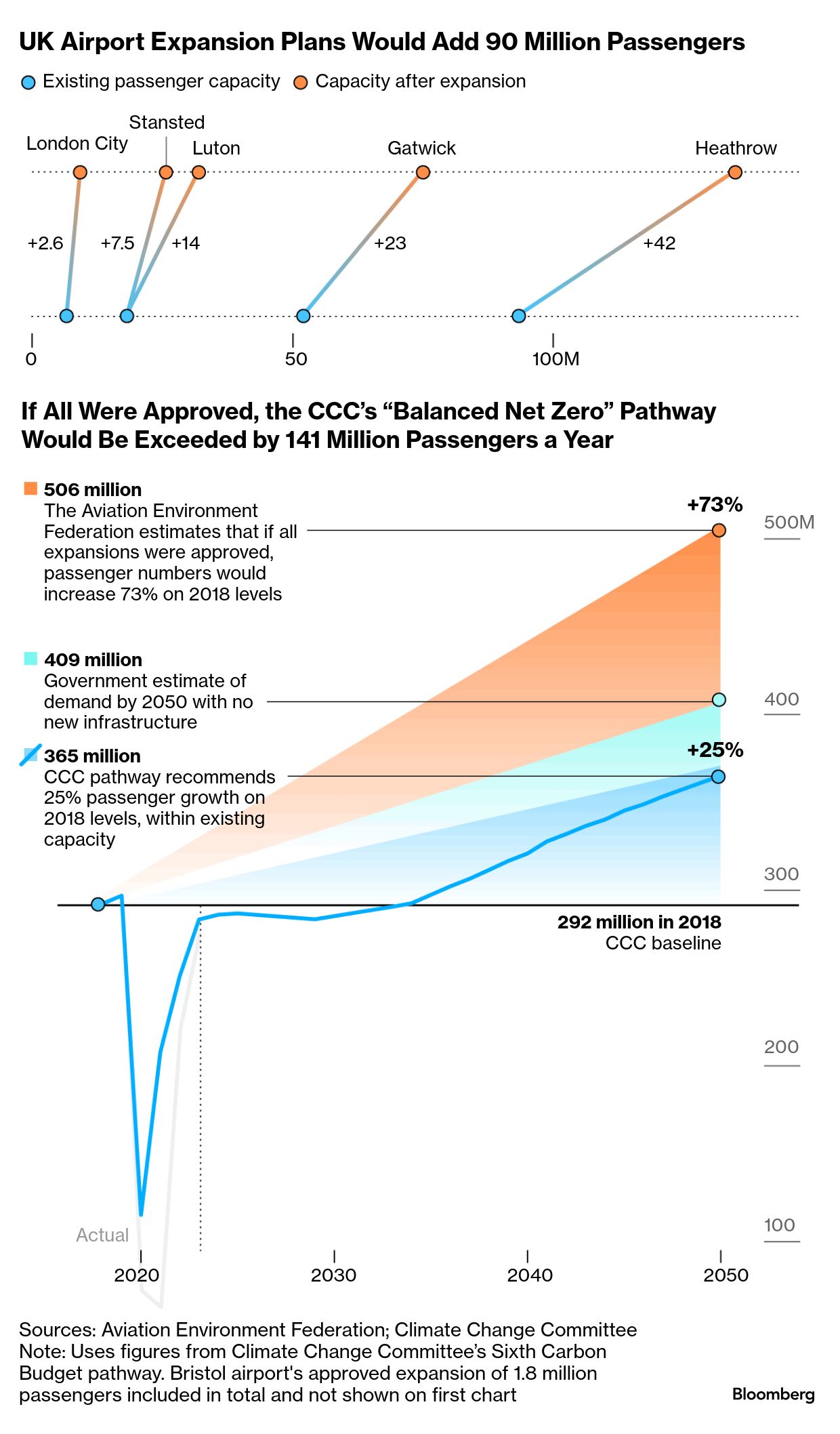

Reeves said this week the government will approve the controversial project to build a third runway at the UK’s largest airport, despite concerns that a jump in air traffic would imperil the country’s drive towards net zero emissions by mid-century.

The mathematics of Reeves’ assertion rely on a big gamble: that emissions reduction technologies will develop fast enough to offset the rise in flights. But, experts say, those technologies are currently expensive, and are yet to prove themselves at scale.

The UK has a legally-binding target of reaching net-zero emissions by 2050. More urgently, the UK needs to slash its emissions by 81%, compared with 1990 levels, in the next 10 years to meet new climate targets submitted to the United Nations. Air travel currently contributes about 7% of UK emissions.

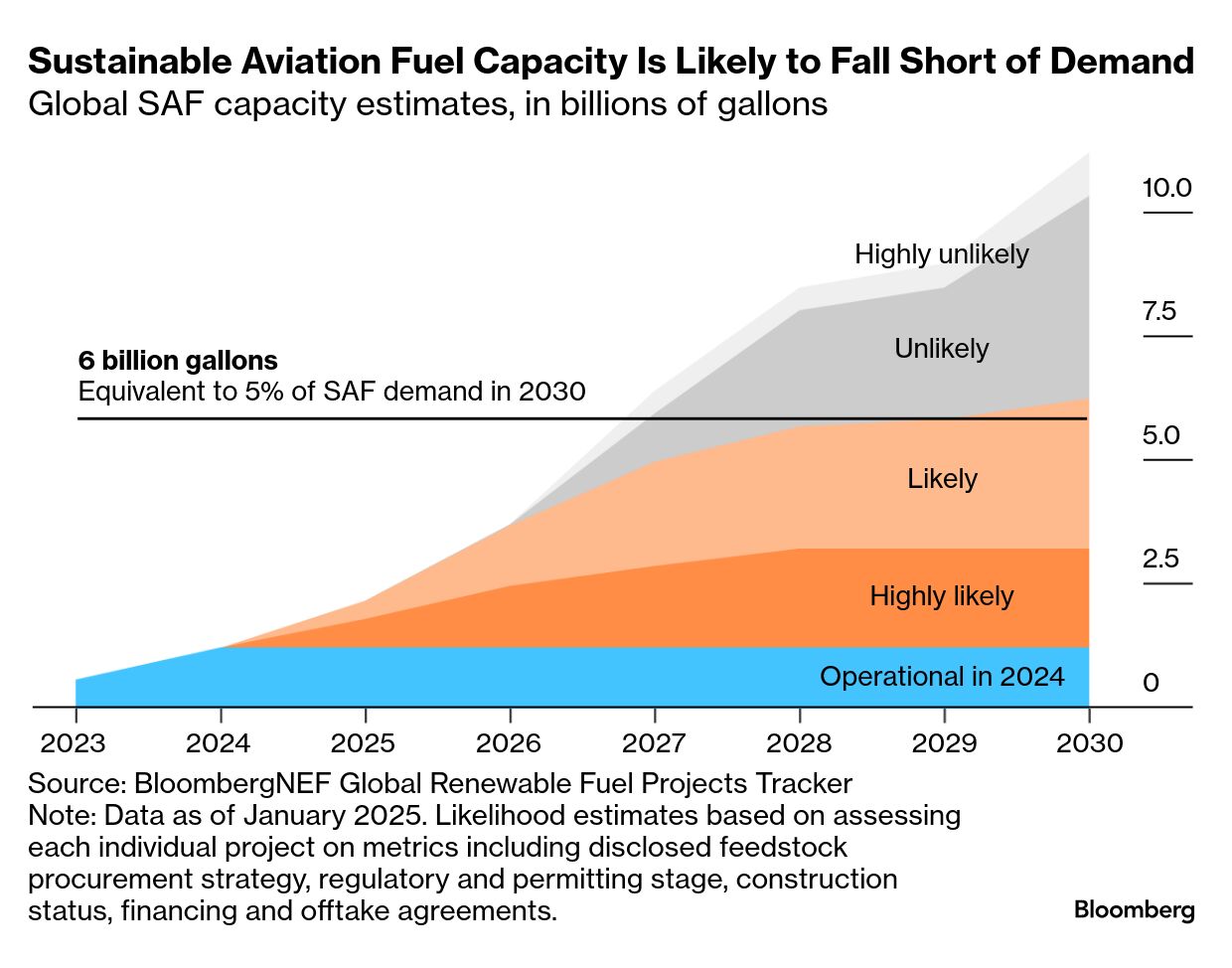

In 2022, under the previous government, the UK published its “Jet Zero” strategy, which promised “guilt-free flying,” powered by hydrogen, battery-operated planes, and sustainable aviation fuels (SAF). Neither hydrogen nor battery-powered aircraft are anywhere near ready for mass commercialization. That means that for at least the next decade, the burden will fall on SAF.

SAF is a broad definition, including fuels from used cooking oil, synthetic fuels made using hydrogen and carbon dioxide, or biofuels made from plants and trees. Calculating exactly how much it cuts carbon emissions over its lifecycle compared to fossil-based jet fuel is difficult, and depends on the type of SAF used. For example, using fuels from waste in some cases results in barely any emissions savings at all. The UK government’s strategy assumes that replacing jet fuel with SAF results in a 70% reduction in lifecycle emissions.

The UK has mandated that by 2030, airlines must replace 10% of their aviation fuel with SAF, rising to 22% by 2040.

Chris Hilson, director of the Centre for Climate and Justice at the University of Reading, calls the UK’s projections for SAFs “overly optimistic,” because the fuel is expensive and hard to produce at scale. “Even with these fuels, flights will still produce significant emissions,” he said.

A UK government spokesperson said it was “committed to delivering greener aviation.” They added: “We are already making great strides in the path to greener aviation, with new targets for sustainable aviation fuel starting this year.”

Heathrow declined to comment.

SAF currently costs at least twice as much as jet fuel. The UK government’s own cost-benefit analysis suggests that to hit its SAF targets would cost the industry around £11.4 billion between now and 2040, although some of these costs would be mitigated by the reduced amount airlines would have to pay in carbon credits.

But that assumes there’s enough SAF to meet the quota. Around the world, manufacturers have struggled to get off the ground. Clean energy researcher BloombergNEF estimates that by 2030 there’ll be enough capacity to meet about 5% of global jet fuel demand. Countries, including Brazil, Japan, South Korea and Indonesia are also planning to introduce SAF mandates, which would put further pressure on supply.

Growing emissions from aviation would put pressure on the other pillars of the UK’s net zero strategy. The government is aiming for 100% “clean” power — mostly from renewable sources — by 2030. One analysis, from Alex Chapman at the New Economics Foundation think tank, projects that expansions at Heathrow, Gatwick and Luton would cancel out the carbon benefits of the clean power plan within five years of the expansion taking place. The runway isn’t expected to be built and operational until 2035.

Even in its most optimistic scenarios, UK aviation is already expected to create a surfeit of around 19 million metric tons of greenhouse gases in 2050, which the government expects to cancel out using carbon removal technologies, such as direct air capture — another technology that doesn’t, as yet, exist at scale.

“You are growing something that doesn’t have the option of being decarbonized right now,” said Alice Larkin, a professor of climate science and energy policy at the University of Manchester.